Adoption Matters: Bitcoin Through the Lens of Network Effects

How is the actual situation of Bitcoin's adoption nowadays? A deep research with adoption metrics: transactions, adresses and coins values.

Good morning guys, in the ever-evolving world of digital assets, Bitcoin continues to stand apart not merely as the first cryptocurrency, but as the most resilient and widely adopted. While its technological and monetary innovations often take the spotlight, one of the most underappreciated drivers of Bitcoin’s long-term value lies in something far more fundamental: network effects.

Network effects explain why a technology, platform, or currency becomes exponentially more valuable as more people use it. From the telephone to the internet, history has shown that adoption often determines survival and dominance. In this post, we’ll explore Bitcoin through this lens unpacking how network effects have shaped its growth, why they matter more than ever in an increasingly competitive crypto landscape, and what this means for its future as a store of value, medium of exchange, and beyond.

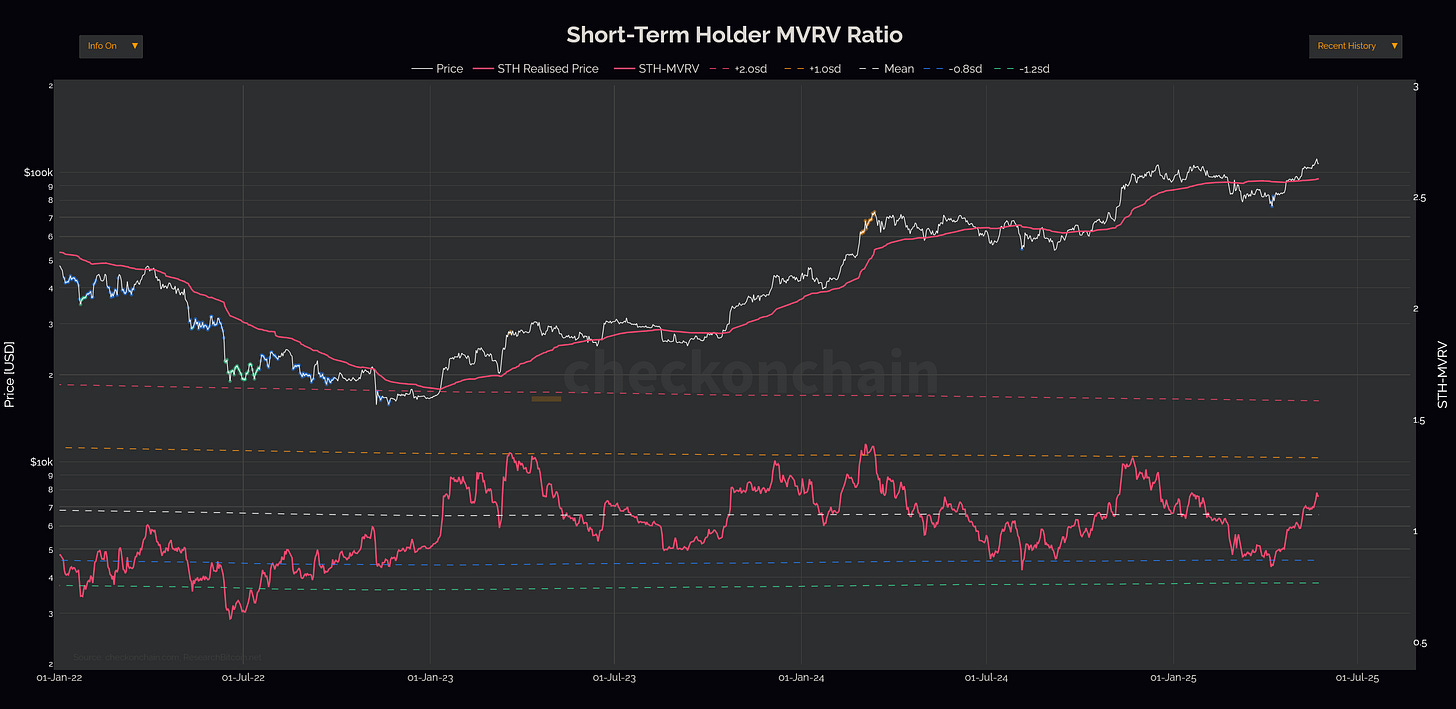

This chart of the Short-Term Holder MVRV Ratio (STH-MVRV) reveals a critical dynamic: even after Bitcoin’s recent price surges, there’s likely room left to run and network effects could be the accelerator.

Why This Matters for Adoption

Price vs. "STH-Reduced Price" (Orange Line):

The gap between market price and STH-cost basis narrows during rallies. A widening gap (like early 2024) hints at speculative froth; today’s tighter spread implies healthier adoption.

Network Effects Kick In:

Every cycle where STHs hold through volatility (rather than panic-selling) reinforces Bitcoin’s resilience narrative—attracting more users, developers, and infrastructure.

Note how volatility (gray area) contracts post-halvings (vertical lines): reduced sell pressure from miners = stronger network cohesion.

The Big Picture

Bitcoin’s price isn’t just a number it’s a reflection of collective belief in its network. When STHs transition to long-term holders (LTHs), the asset’s liquidity shock potential grows—a hallmark of Metcalfe’s Law in action.

SUMMARY:

Active Address Momentum

Proxy for userbase growth: Accelerating adoption or speculative waves?

Transaction Momentum

Blockchain activity pulse: Are rising transactions driven by utility or congestion?

Transfer Volume Momentum

Economic throughput: Scaling value settlement vs. speculative churn.

Coinday Value Destroyed Momentum

Holder behavior shift: Long-term coins moving = breaking stagnation.